- This event has passed.

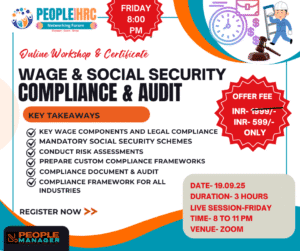

Workshop: Wage & Social Security Compliance, Audit & Inspection Management

September 19 @ 8:00 pm – 10:30 pm

💼 Wages & Social Security Regulations Compliance, Audit & Inspection Management

Stay audit-ready. Stay compliant. Master wage and social security laws to protect your organization.

Online Practical Training Workshop

📅 Date: September 18, 2025

🕗 Time: 8:00 PM – 11:00 PM IST

🧠 Duration: 3 Hours

📍 Mode: Zoom Live

🔍 Workshop Overview

In today’s regulatory environment, non-compliance with wage and social security laws can result in penalties, reputational damage, and operational risks. As enforcement intensifies, HR and compliance professionals must be proactive, well-informed, and audit-ready.

This 3-hour practical workshop, led by a Labour Laws Compliance Strategist, is designed to help participants understand, implement, and manage wage and social security compliance across sectors. It will also focus on handling inspections and audits confidently and lawfully.

Whether you’re in HR, finance, or compliance, this session provides the tools to manage risk, ensure statutory adherence, and build a culture of lawful operation.

🧾 Key Legislations Covered

This intensive Workshop offers a comprehensive overview of the following labor laws:

| Acts | 🛠️ Focus Area |

|---|---|

| Payment of Wages Act, 1936 | Timely & lawful disbursement of wages |

| Minimum Wages Act, 1948 | Ensuring baseline earnings by category |

| Payment of Bonus Act, 1965 | Statutory bonus eligibility & calculation |

| Equal Remuneration Act, 1976 | Gender parity in compensation |

| Employees’ Provident Funds and Misc. Provisions Act, 1952 | PF contribution, administration & audits |

| Employees’ State Insurance Act, 1948 | ESIC coverage & benefits administration |

| Maternity Benefit Act, 1961 | Leave entitlements & employer obligations |

| Payment of Gratuity Act, 1972 | Gratuity computation & eligibility |

| Employees’ Compensation Act, 1923 | Compensation for workplace injuries |

| Unorganised Workers’ Social Security Act, 2008 | Welfare provisions for unorganised sector |

| Cine Workers Welfare Fund Act, 1981 | Specific social security provisions |

🎯 What You Will Learn

✅ Key wage components and legal compliance under central and state laws

✅ Mandatory social security schemes (EPF, ESI, gratuity, etc.) and their applicability

✅ What inspectors look for during audits — and how to prepare

✅ How to maintain registers, records, and digital proof of compliance

✅ Do’s and Don’ts during labour inspections

✅ Red flags that trigger audits — and how to avoid them

📅 Key Agenda

Sessions | Details |

Introduction & Compliance Landscape | Importance of wage & social security compliance |

Wage Compliance Demystified | Rules on minimum wages, deductions, and payment timelines |

Social Security Obligations | EPF, ESI, gratuity, labour welfare fund – coverage and contribution norms |

Labour Audits & Inspections | What authorities check, documentation needed, and how to be inspection-ready |

Real-World Scenarios + Compliance Toolkit | Case studies, audit triggers, and best practices |

Q&A + Action Plan | Open Q&A and step-by-step compliance roadmap |

👩🏫 Who Should Attend

This workshop is ideal for:

- HR & Payroll Professionals

- Compliance Officers & Legal Advisors

- Finance Managers

- Factory/Plant Managers

- Labour Law Consultants

- Business Owners and Startups managing in-house compliance

- Anyone responsible for wage, EPF, or ESI compliance

📝 Registration Details

| 💻 Regular Fee | ₹ 1999 (inclusive of taxes) |

|---|---|

| 🎫 Special Offer | ₹ 599 (First 5 Enrollment) |

Includes:

- Access to Session recording

- Workshop kit: compliance checklists, RACI charts, model registers

- Certificate of Participation

📩 Register Now

Register Here Just at 599 only

🎯 Key Takeaways & Skill Gains

By the end of this workshop, you’ll be able to:

- 🕵️♂️ Identify Compliance Needs across locations, teams & roles

- ⚖️ Interpret Statutory Obligations with confidence and precision

- 🧭 Conduct Risk Assessments tailored to industry-specific operations

- 🛡️ Prepare Custom Compliance Frameworks aligned with legal benchmarks

- 📊 Implement Monitoring Tools for policy enforcement & issue escalation

- 🗂️ Document & Audit for inspections, litigation protection & reporting

- Train Internal Teams to uphold safety and legal mandates

🚀 Enroll Today – Build a Safer, Legally Sound Workplace

Seats Are Limited. Don’t Miss Out.

🎟️ ₹ 1999 599 Only

Register Now Here – https://u.payu.in/PAYUMN/Jrg1tcaQYfCL

Regards

PMHRC