- This event has passed.

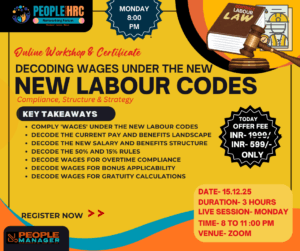

Workshop: Decoding Wages Under the New Wage Code

🚀 Decoding Wages Under the New Wage Code 2019: Compliance, Structure & Strategy

3-Hour Live Online Workshop

Master the New Definition of ‘Wages’ and Re-engineer Your Compensation for 100% Compliance.

Are You Prepared for India’s Biggest Compensation Overhaul?

The implementation of the New Wage Code, 2019, brings a single, standardized definition of ‘Wages’ that fundamentally changes how you calculate mandatory employer obligations like Gratuity, PF, ESI, and Bonus. Non-compliance could lead to significant financial penalties and unexpected increases in your Cost-to-Company (CTC).

This 3-hour power-packed workshop is designed to provide HR Leaders, Payroll Managers, and Finance Executives with a practical, step-by-step framework to navigate the complexities, restructure salary components, and ensure seamless compliance.

🎯 Key Learning Modules: What You Will Master

This workshop dives deep into the statutory provisions that directly impact your organization’s financials and employee compensation structure.

Module 1: Decoding ‘Wages’ under the New Labour Codes

Simplified Clarity on Inclusions and Exclusions: A precise breakdown of the components that must be counted as ‘Wages’ (Basic Pay, Dearness Allowance, Retaining Allowance) and the items that are explicitly excluded (HRA, Overtime, Bonus, etc.).

The Single Definition Impact: Understanding how this uniform definition replaces multiple definitions across four subsumed laws (Payment of Wages Act, Minimum Wages Act, etc.) and its cascading effect on all statutory calculations.

Module 2: Decoding the Current Pay and Benefits Landscape

Insight-Driven Review of Compensation Structures: Learn to audit your current salary breakup to identify statutory and compliance gaps under the new Code.

Case Studies: Analysis of typical pre-Code salary structures and the immediate financial and compliance risks they face upon implementation.

Module 3: Decoding the New Salary and Benefits Structure

Practical Framework for Redesigning Packages: Step-by-step guidance on restructuring CTC and salary components to align with the new statutory definition of ‘Wages.’

The 15% Rule: Understanding how non-monetary components (remuneration in kind) are valued and how their value, limited to 15% of total remuneration, forms part of ‘Wages.’

Module 4: Decoding the 50% Rule and Compliance Strategy

Detailed Explanation of the Statutory Thresholds: The critical provision stating that the sum of all excluded components cannot exceed 50% of the employee’s total remuneration.

If the exclusions exceed 50%, the excess amount must be added back to ‘Wages.’

Structuring Strategy: Strategies to minimize the financial impact on CTC while maximizing employee social security benefits, including the interplay with the existing EPF wage ceiling.

Module 5: Decoding Wages for Specific Statutory Compliance

A focused, practical interpretation of how the new ‘Wages’ definition impacts key employer liabilities:

Decoding Wages for Overtime Compliance: Operational understanding of employer obligations to pay overtime at a rate at least twice the normal wage rate, calculated on the new, higher wage base.

Decoding Wages for Bonus Applicability: Focused interpretation of how the new wage definition influences bonus eligibility and calculation, unifying the approach across the organization.

Decoding Wages for Gratuity Calculations: Practical view of wage composition and the likely increased liability for Gratuity, especially for companies with historically low basic pay, including the new provision for fixed-term employees.

🗓️ Workshop Details

| Detail | Information |

| Duration | 3 Hours (Live Online) |

| Date & Time | Monday, December 15, 2025, 8:00 pm to 11:00 pm |

| Platform | Zoom LIVE (Link will be provided post Registration) |

| Takeaways | Completion Certificate, Statutory Checklist, Ready-to-use Sample Salary Restructuring Template |

⭐ Who Must Attend?

HR Heads & Managers

Payroll & Compensation/Benefits Specialists

CFOs, Finance Controllers, and Accounts Teams

Business Owners & CXOs

💰 Investment

Regular Fee : ₹1,999/- Only

Special Offer : ₹599 /- Only

Secure Your Spot Now and Turn a Compliance Challenge into a Strategic Advantage.

REGISTER NOW – HERE